Arkansas Taxes Calculator

Arkansas Income Tax Calculator - SmartAsset

Arkansas Income Tax Calculator - SmartAsset Find out how much you'll pay in Arkansas state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

https://smartasset.com/taxes/arkansas-tax-calculator

Arkansas Tax Calculator: Estimate Your Taxes - Forbes Advisor

Arkansas Income Tax Calculator 2021 If you make $70,000 a year living in the region of Arkansas, USA, you will be taxed $12,387. Your average tax rate is 11.98% and your marginal tax rate is 22%....

https://www.forbes.com/advisor/income-tax-calculator/arkansas/Arkansas Paycheck Calculator - SmartAsset

SmartAsset's Arkansas paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home pay. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator

https://smartasset.com/taxes/arkansas-paycheck-calculator

Arkansas State Tax Calculator - Good Calculators

To use our Arkansas Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

https://goodcalculators.com/us-salary-tax-calculator/arkansas/

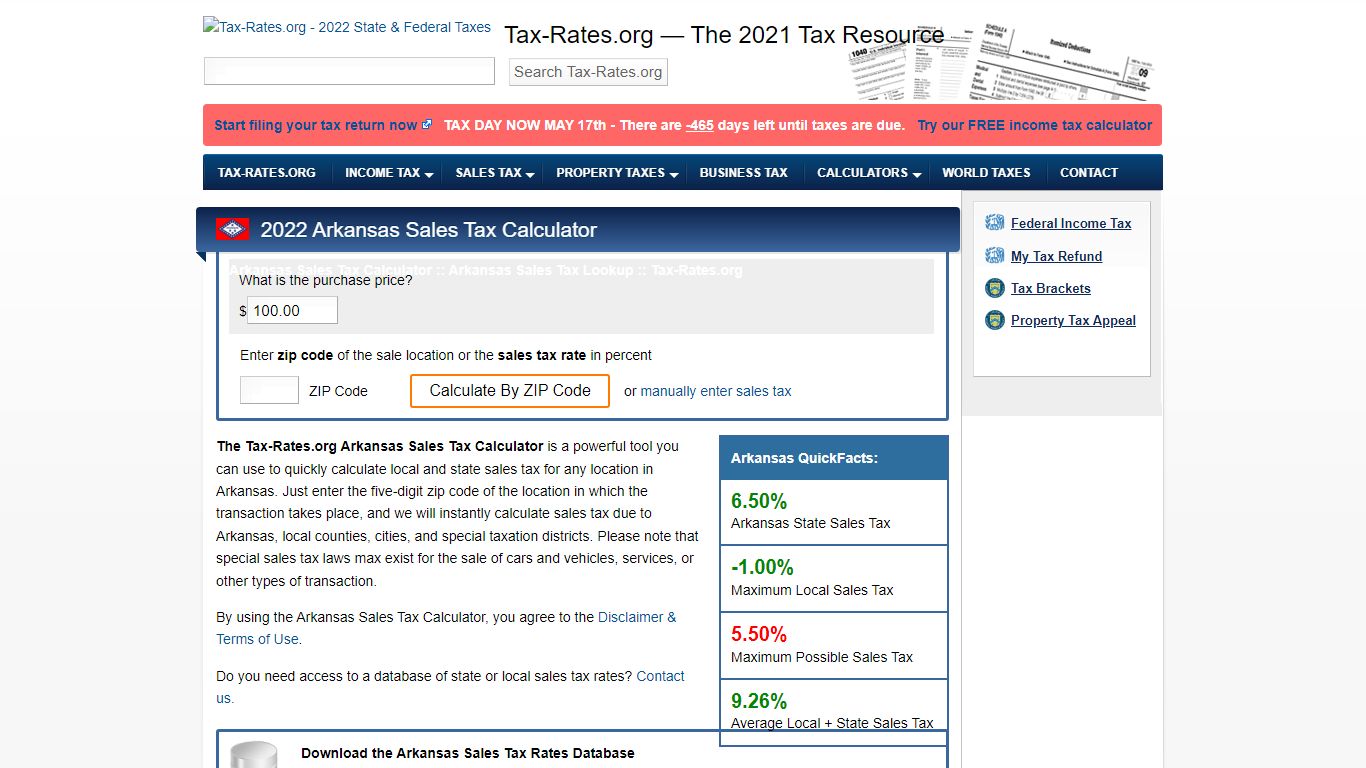

Arkansas Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Arkansas, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/arkansas/sales-tax-calculator

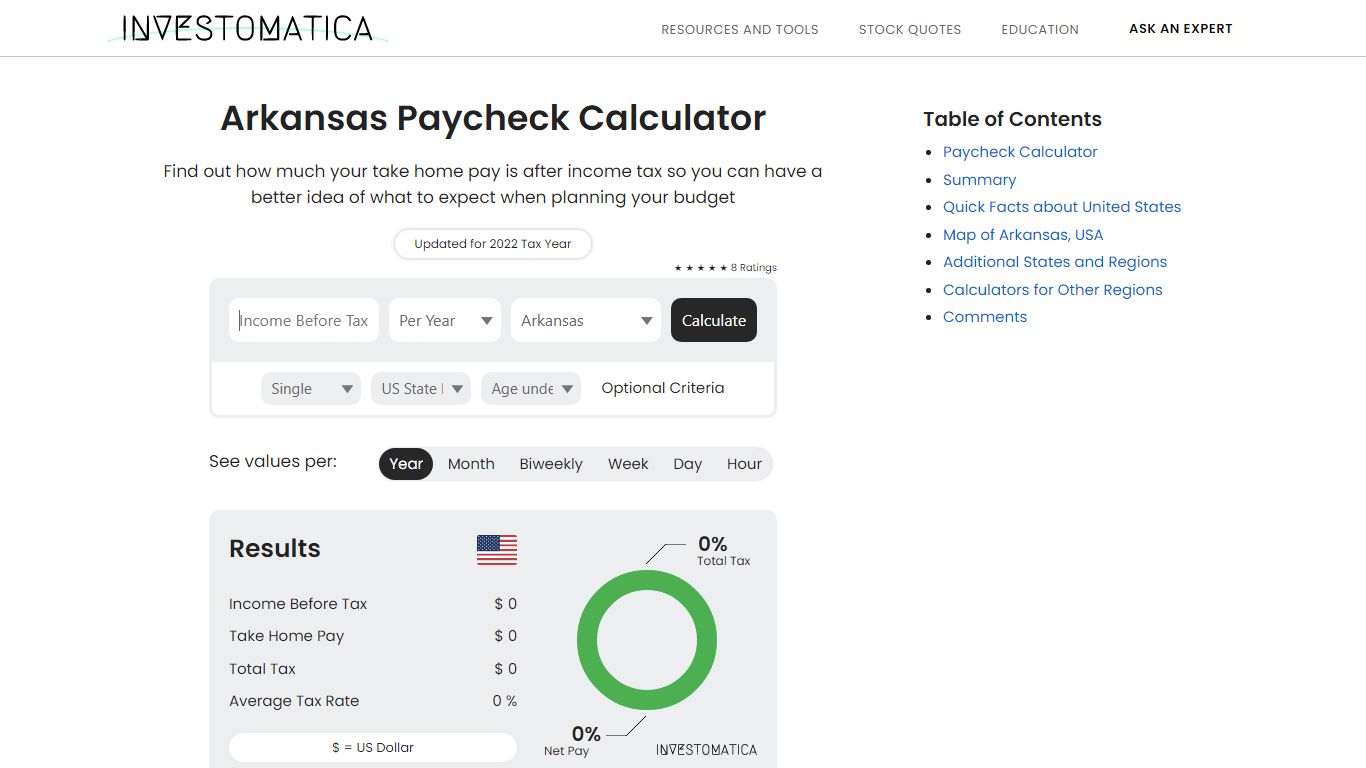

Arkansas Income Tax Calculator - Investomatica

The state income tax rate in Arkansas is progressive and ranges from 0% to 5.9% while federal income tax rates range from 10% to 37% depending on your income. This income tax calculator can help estimate your average income tax rate and your salary after tax. How many income tax brackets are there in Arkansas?

https://investomatica.com/income-tax-calculator/united-states/arkansas

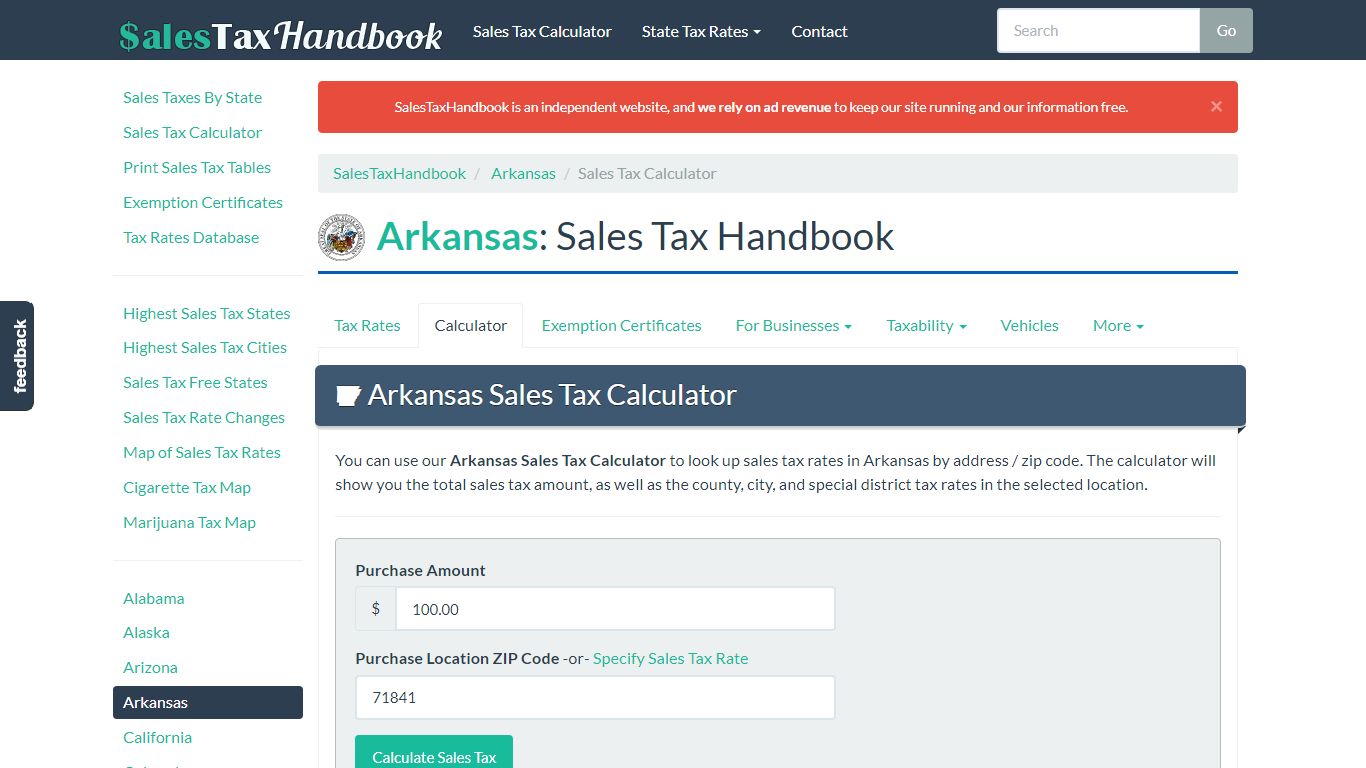

Arkansas Sales Tax Calculator - SalesTaxHandbook

You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/arkansas/calculator

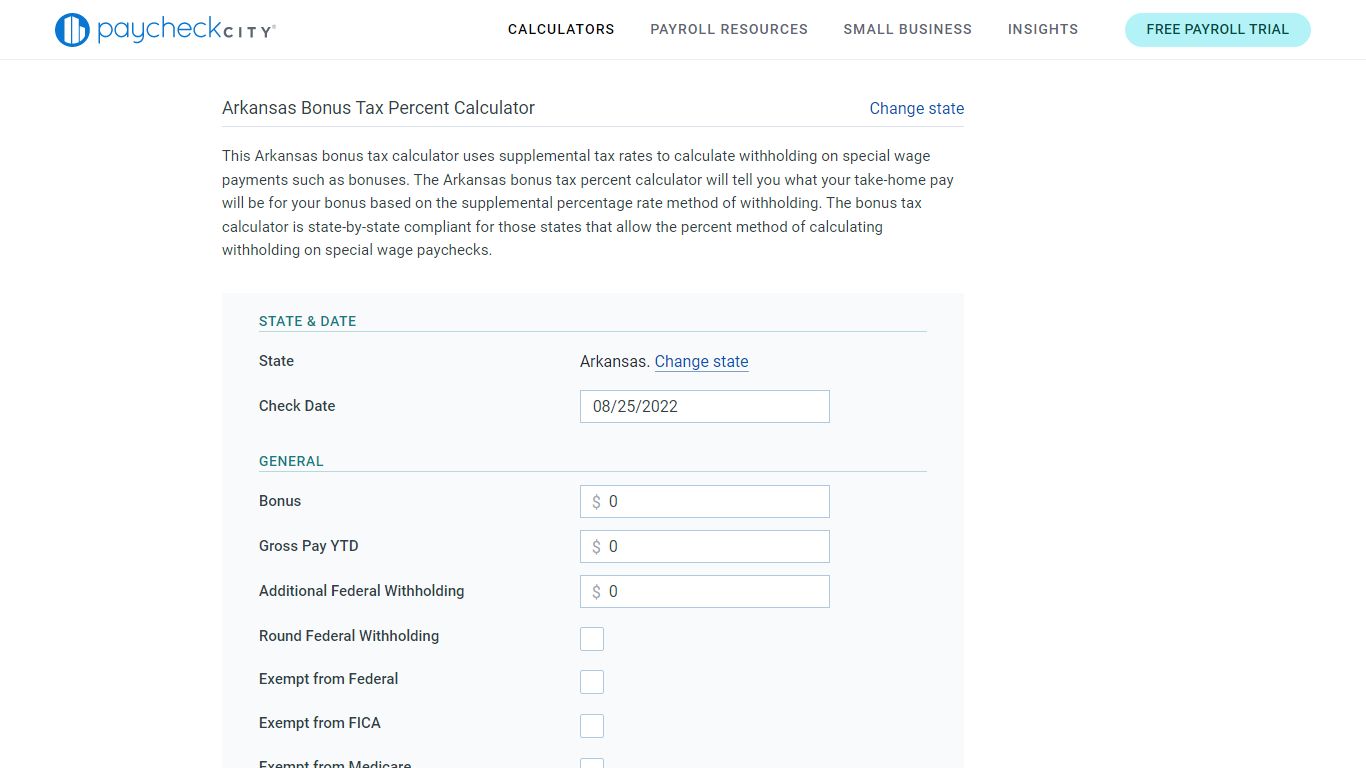

Arkansas Bonus Tax Calculator - Percent · PaycheckCity

The Arkansas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. State & Date. State.

https://www.paycheckcity.com/calculator/flatbonus/arkansas/

Free Arkansas Payroll Calculator | 2022 AR Tax Rates | OnPay

As an employer in Arkansas, you have to pay unemployment insurance to the state. The 2022 rates range from 0.3% to 14.2% on the first $10,000 in wages paid to each employee in a calendar year. If you’re a new employer (congratulations on getting started!), you pay a flat rate of 3.1% (this is including a 0.3% stabilization tax).

https://onpay.com/payroll/calculator-tax-rates/arkansas

Arkansas Income Tax Calculator 2021 - 2022 - taxuni.com

Using the calculator will help you calculate the tax due for the year by subtracting the state tax and any federal taxes you may have already paid. The income tax calculator in Arkansas will include the personal exemptions and deductions you are entitled to.

https://www.taxuni.com/arkansas-income-tax-calculator/

Arkansas Paycheck Calculator | ADP

Arkansas Paycheck Calculator Use ADP’s Arkansas Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.

https://www.adp.com/resources/tools/calculators/states/arkansas-salary-paycheck-calculator.aspx